Oaktree Specialty Lending – Why I am investing in it!

Why I am buying Oaktree?

A few reasons, here are the top ones:

Reason #1

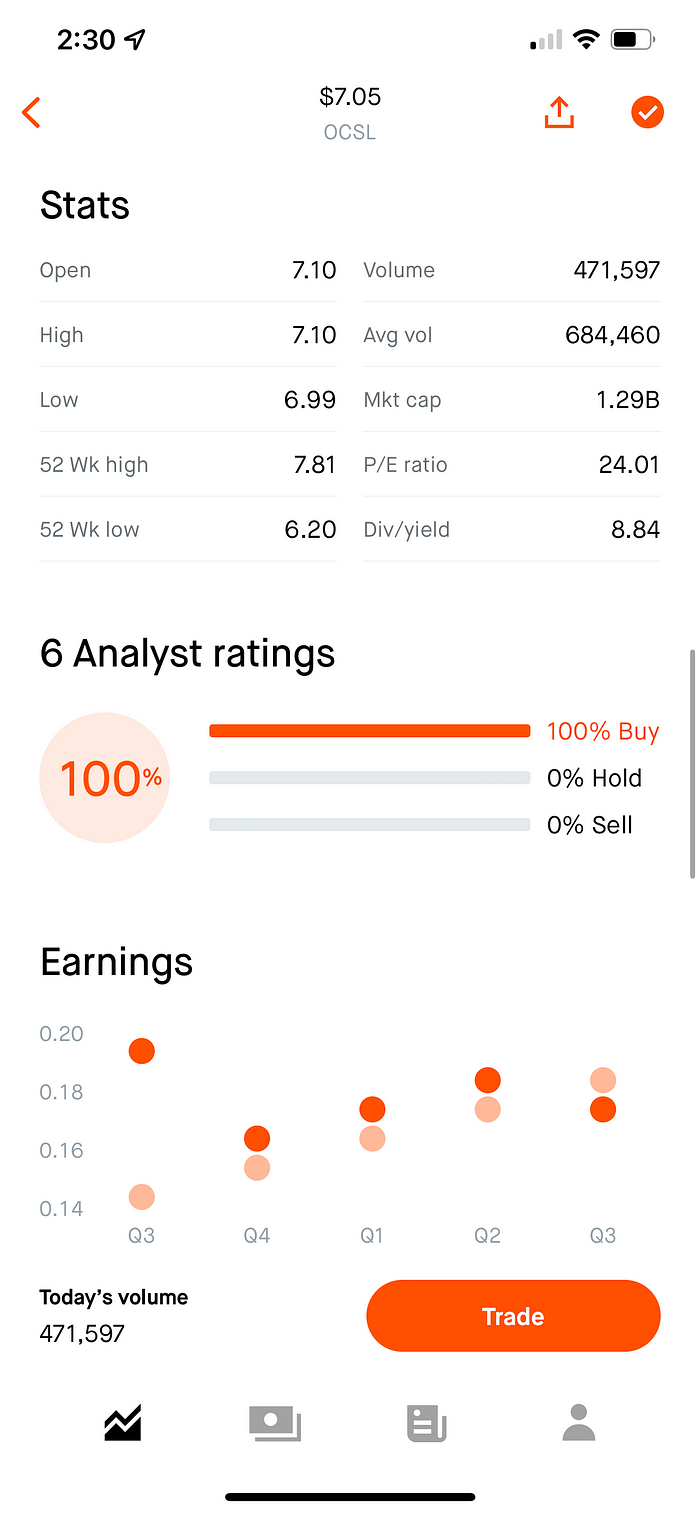

8.84% divided as per Robinhood at the time of this writing. That’s an awesome divided by the way. (see bellow)

Reason # 2

Robinhood App, 6 Analyst ratings of 100% buy. This is very rare indeed. You dont see it every day. (see bellow)

Reason # 3

It’s a BDC (business development company) and they tend to pay high dividends, and I am looking to add substantial cash to my overall investments in this sector. Oaktree is just one of many companies I am investing in to meet this goal.

Reason # 4

Earnings per share are trending in the right direction (mostly increasing)and appear to be stable, ranging from $0.17 to $0.18 per share. (see bellow screenshot)

Reason #5

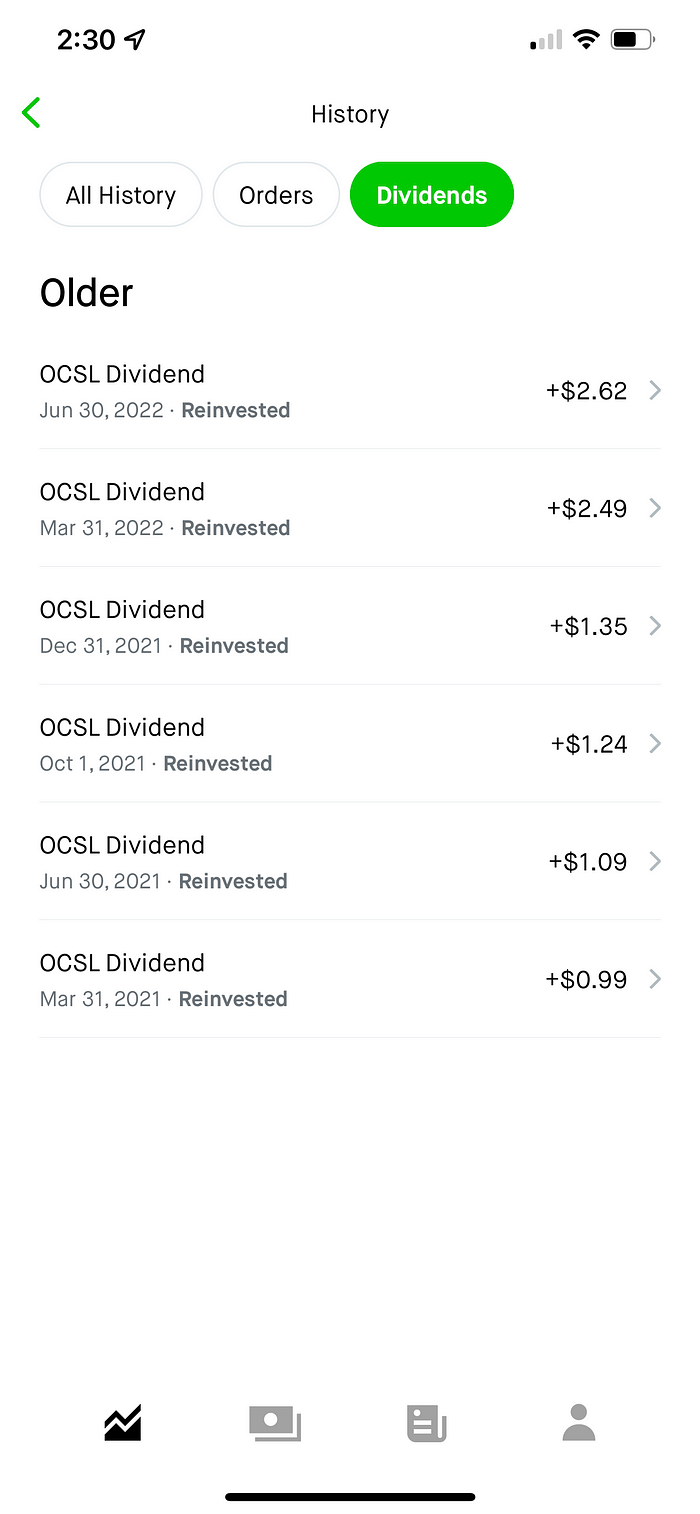

Growth in dividend payout per share. Most recently, paying $0.165 per share as of 6/30/22, which is up from $0.13 same time, last year.

Dividends per share over time:

- Jun 30, 22 = $0.165 per share

- Mar 31, 22 = $0.16 per share

- Dec 31, 21 = $0.155 per share

- Oct 1, 21 = $0.145 per share

- Jun 30, 21 = $0.13 per share

- Mar 31, 21 = $0.12 per share

Oaktree is part of my 2022 BDC Master list of BDC that at this point look to be great buys.

Disclosure: I have a beneficial long term position in the shares of Oaktree via stock ownership. I wrote this article myself, and it shares my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational and entertainment purposes and does not constitute as financial advice. I encourage you and expect you to do your own due diligence and draw your own conclusions prior to making any investment decisions.